阿根廷¶

网络研讨会¶

您可以在下面找到带有本地化的一般说明以及如何配置它的视频。

配置¶

模块安装¶

Install the following modules to get all the features of the Argentinean localization:

名称 |

技术名称 |

描述 |

|---|---|---|

Argentina - Accounting |

|

Default fiscal localization package, which represents the minimal configuration to operate in Argentina under the AFIP regulations and guidelines. |

Argentinean Accounting Reports |

|

VAT Book report and VAT summary report. |

Argentinean Electronic Invoicing |

|

Includes all technical and functional requirements to generate electronic invoices via web service, based on the AFIP regulations. |

|

(optional) Allows the user to see Identification Type and AFIP Responsibility in the eCommerce checkout form in order to create electronic invoices. |

Configure your company¶

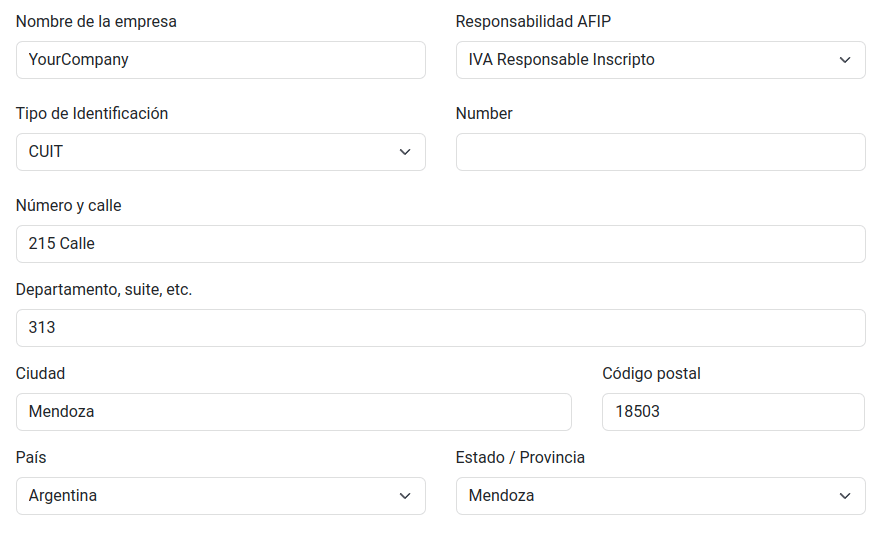

Once the localization modules are installed, the first step is to set up the company’s data. In addition to the basic information, a key field to fill in is the AFIP Responsibility Type, which represents the fiscal obligation and structure of the company.

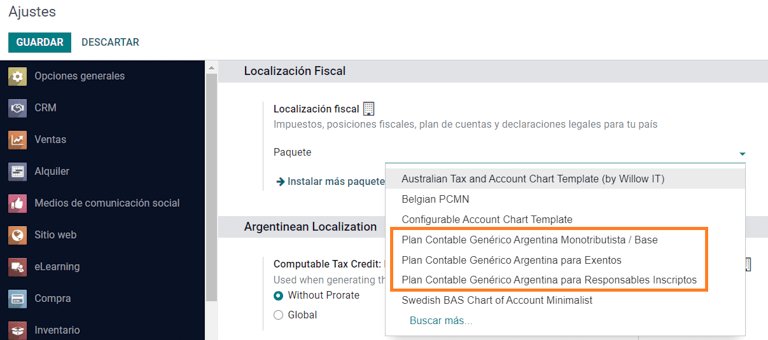

科目表¶

In Accounting, there are three different Chart of Accounts packages to choose from. They are based on a company’s AFIP responsibility type, and consider the difference between companies that do not require as many accounts as the companies that have more complex fiscal requirements:

Monotributista (227 accounts);

IVA Exento (290 accounts);

Responsable Inscripto (298 Accounts).

Configure master data¶

Electronic Invoice Credentials¶

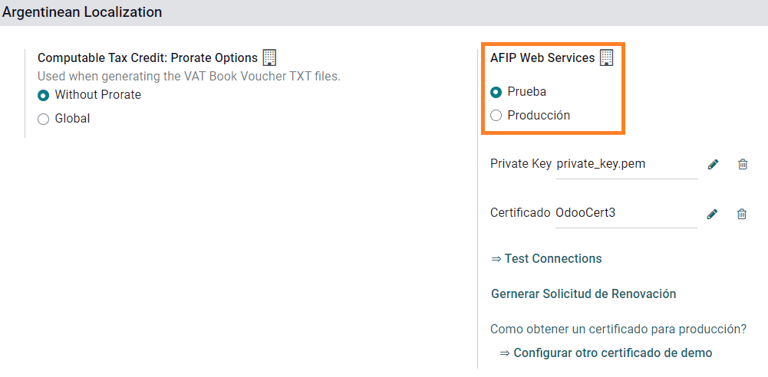

环境¶

The AFIP infrastructure is replicated in two separate environments, testing and production.

Testing is provided so that the companies can test their databases until they are ready to move into the Production environment. As these two environments are completely isolated from each other, the digital certificates of one instance are not valid in the other one.

To select a database environment, go to and choose either Prueba (Testing) or Produccion (Production).

AFIP certificates¶

The electronic invoice and other AFIP services work with Web Services (WS) provided by the AFIP.

In order to enable communication with the AFIP, the first step is to request a Digital Certificate if you do not have one already.

Generate Certificate Sign Request (Odoo). When this option is selected, a file with extension

.csr(certificate signing request) is generated to be used in the AFIP portal to request the certificate.

Generate Certificate (AFIP). Access the AFIP portal and follow the instructions described in this document to get a certificate.

Upload Certificate and Private Key (Odoo). Once the certificate is generated, upload it to Odoo using the Pencil icon next to the field Certificado and select the corresponding file.

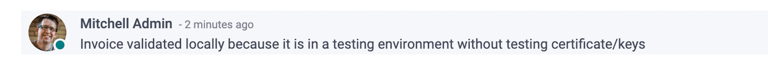

小技巧

In case you need to configure the Homologation Certificate, please refer to the AFIP official documentation: Homologation Certificate. Furthermore, Odoo allows the user to test electronic invoicing locally without a Homologation Certificate. The following message will be in the chatter when testing locally:

往来单位¶

Identification type and VAT¶

作为阿根廷本地化的一部分,由 AFIP 定义的文件类型现在可在**合作伙伴表格**中使用。对于大多数交易来说,信息是必要的。默认情况下有 6 种 识别类型 可用,还有 32 种非有效类型。

注解

Odoo 中包含 AFIP 定义的:guilabel:`标识类型`的完整列表,但只有常用的标识类型是有效的。

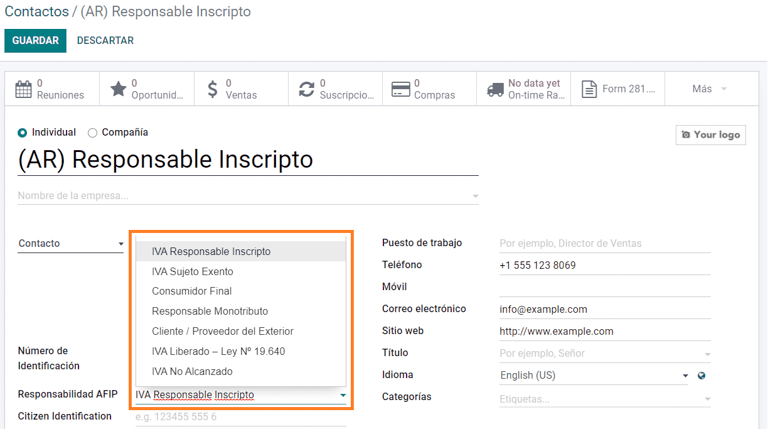

AFIP 责任类型¶

在阿根廷,与客户和供应商相关的单据类型和相应交易由 AFIP 责任类型定义。该字段应在**合作伙伴表**中定义。

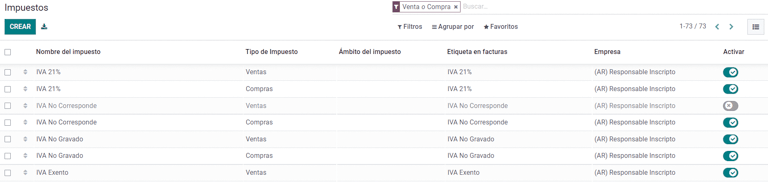

税¶

As part of the localization module, the taxes are created automatically with their related financial account and configuration, e.g., 73 taxes for Responsable Inscripto.

Taxes types¶

Argentina has several tax types, the most common ones are:

VAT: this is the regular VAT and can have various percentages;

Perception: advance payment of a tax that is applied on invoices;

Retention: advance payment of a tax that is applied on payments.

Special taxes¶

Some Argentinean taxes are not commonly used for all companies, and those less common options are labeled as inactive in Odoo by default. Before creating a new tax, be sure to check if that tax is not already included as inactive.

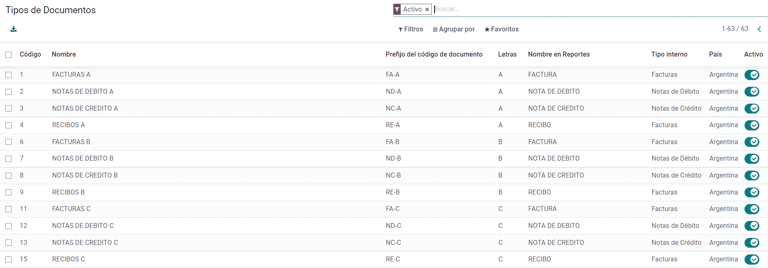

文件类型¶

在一些拉丁美洲国家/地区,例如阿根廷,某些会计交易(如发票和供应商账单)根据政府税务机构定义的文件类型进行分类。在阿根廷,AFIP <https://www.afip.gob.ar/> 是负责定义此类交易的政府税务机构。

文档类型是在列出账户流水的打印报告、发票和日记账条目中需要清晰显示的重要信息。

每种文件类型在其指定的日记账中都有唯一的序列。作为本地化的一部分,文档类型包括文档适用的国家/地区(安装本地化模块时会自动创建此数据)。

默认情况下,文档类型 所需的信息已包含在内,因此用户无需在此视图中填写任何内容:

注解

有几种 文件类型 类型默认未生效,但可根据需要激活。

信¶

For Argentina, the Document Types include a letter that helps indicate the type of transaction or operation. For example, when an invoice is related to a(n):

B2B transaction, a document type A must be used;

B2C transaction, a document type B must be used;

Exportation Transaction, a document type E must be used.

The documents included in the localization already have the proper letter associated with each Document Type, so there is no further configuration necessary.

Use on invoices¶

The Document Type on each transaction will be determined by:

The journal entry related to the invoice (if the journal uses documents);

The onditions applied based on the type of issuer and receiver (e.g., the type of fiscal regime of the buyer and the type of fiscal regime of the vendor).

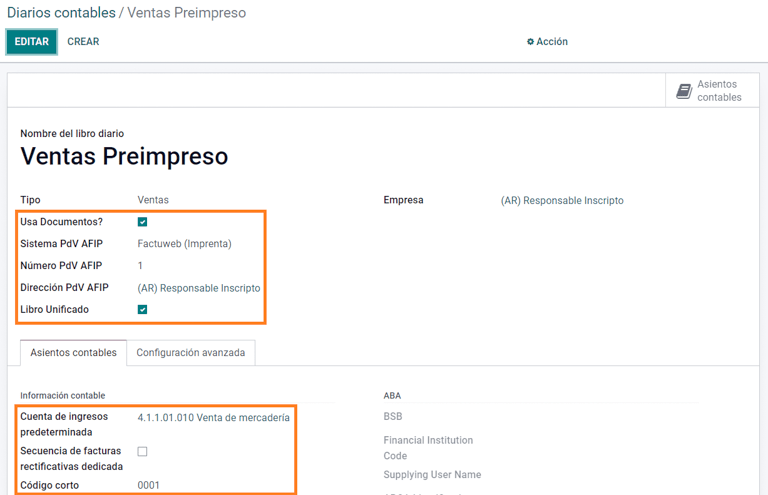

日记账¶

在阿根廷本地化中,日记账可根据其用途和内部类型采用不同的方法。要配置日记账,请访问 。

对于销售和采购日记账,可激活 使用文件 选项,该选项可启用与发票和供应商账单相关的 文件类型`列表。有关发票的更多详情,请参阅 :ref:`2.3 文档类型<document-types>。

如果销售或采购日记账没有激活 :guilabel:`使用文件`选项,它们将无法生成财务发票,这意味着它们的用例将主要限于监控与内部控制流程有关的账户变动。

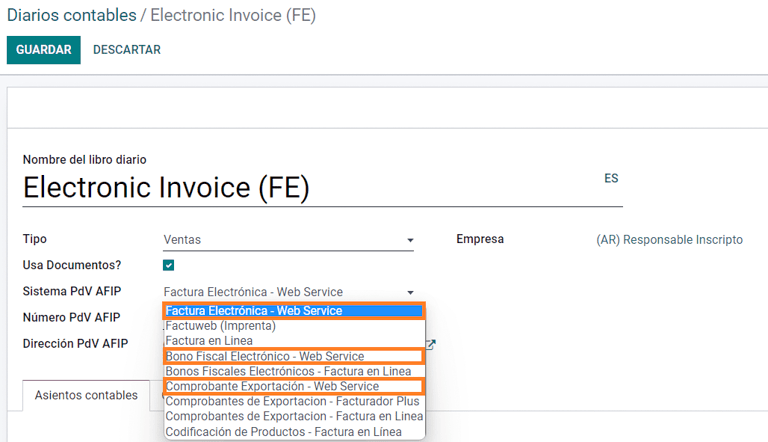

AFIP 信息(又称 AFIP 销售点)¶

AFIP POS 系统 是一个仅在**销售**日记账中可见的字段,定义了用于管理创建日记账的交易的 AFIP POS 类型。

AFIP POS 定义如下:

与网络服务相关的文件类型序列;

电子发票文件的结构和数据。

网站服务¶

**网站服务**可帮助生成不同用途的发票。以下是几个可供选择的选项:

wsfev1:电子发票:最常见的服务,用于生成 A、B、C、M 文档类型的发票,每个项目无明细;

wsbfev1: Electronic Fiscal Bond: is for those who invoice capital goods and wish to access the benefit of the Electronic Tax Bonds granted by the Ministry of Economy. For more details go to: Fiscal Bond;

wsfexv1: Electronic Exportation Invoice: is used to generate invoices for international customers and transactions that involve exportation processes, the document type related is type “E”.

Here are some useful fields to know when working with web services:

AFIP POS Number: is the number configured in the AFIP to identify the operations related to this AFIP POS;

AFIP POS Address: is the field related to the commercial address registered for the POS, which is usually the same address as the company. For example, if a company has multiple stores (fiscal locations) then the AFIP will require the company to have one AFIP POS per location. This location will be printed in the invoice report;

Unified Book: when the AFIP POS System is Preimpresa, then the document types (applicable to the journal) with the same letter will share the same sequence. For example:

发票:FA-A 0001-00000002;

Credit Note: NC-A 0001-00000003;

Debit Note: ND-A 0001-00000004.

序列 Sequences¶

For the first invoice, Odoo synchronizes with the AFIP automatically and displays the last sequence used.

注解

When creating Purchase Journals, it’s possible to define whether they are related to document types or not. In the case where the option to use documents is selected, there would be no need to manually associate the document type sequences, since the document number is provided by the vendor.

用法和测试¶

发票¶

The information below applies to invoice creation once the partners and journals are created and properly configured.

Document type assignation¶

When the partner is selected, the Document Type field will be filled in automatically based on the AFIP document type:

Invoice for a customer IVA Responsable Inscripto, prefix A is the type of document that shows all the taxes in detail along with the customer’s information.

Invoice for an end customer, prefix B is the type of document that does not detail the taxes, since the taxes are included in the total amount.

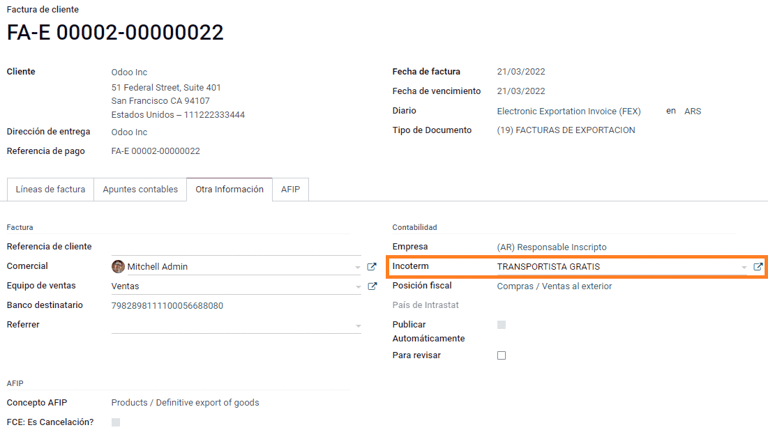

Exportation Invoice, prefix E is the type of document used when exporting goods that shows the incoterm.

Even though some invoices use the same journal, the prefix and sequence are given by the Document Type field.

The most common Document Type will be defined automatically for the different combinations of AFIP responsibility type but it can be updated manually by the user before confirming the invoice.

Electronic invoice elements¶

When using electronic invoices, if all the information is correct then the invoice is posted in the standard way unless there is an error that needs to be addressed. When error messages pop up, they indicate both the issue that needs attention along with a proposed solution. If an error persists, the invoice remains in draft until the issue is resolved.

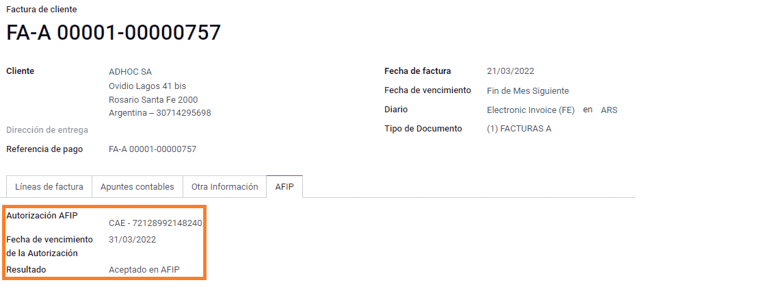

Once the invoice is posted, the information related to the AFIP validation and status is displayed in the AFIP tab, including:

AFIP Autorisation: CAE number;

Expiration Date: deadline to deliver the invoice to the customers (normally 10 days after the CAE is generated);

Result: indicates if the invoice has been Aceptado en AFIP and/or Aceptado con Observaciones.

Invoice taxes¶

Based on the AFIP Responsibility type, the VAT tax can apply differently on the PDF report:

A. Tax excluded: in this case the taxed amount needs to be clearly identified in the report. This condition applies when the customer has the following AFIP Responsibility type of Responsable Inscripto;

B. Tax amount included: this means that the taxed amount is included as part of the product price, subtotal, and totals. This condition applies when the customer has the following AFIP Responsibility types:

IVA Sujeto Exento;

Consumidor Final;

Responsable Monotributo;

IVA liberado.

Special use cases¶

Invoices for services¶

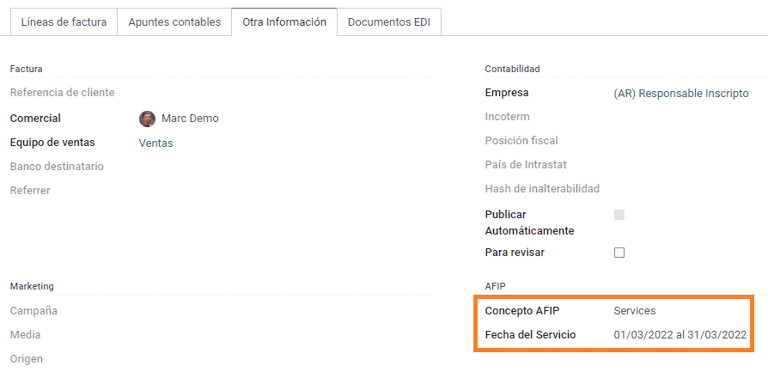

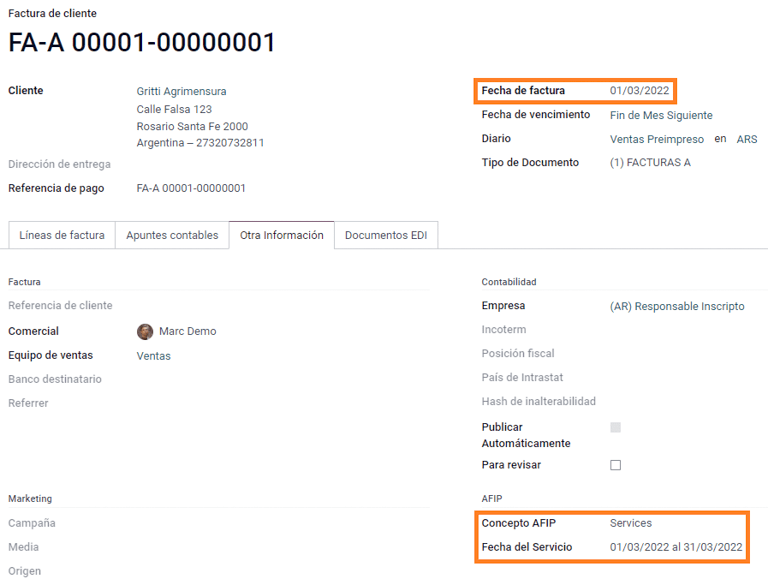

For electronic invoices that include Services, the AFIP requires to report the service starting and ending date, this information can be filled in the tab Other Info.

If the dates are not selected manually before the invoice is validated, the values will be filled automatically with the first and last day of the invoice’s month.

Exportation invoices¶

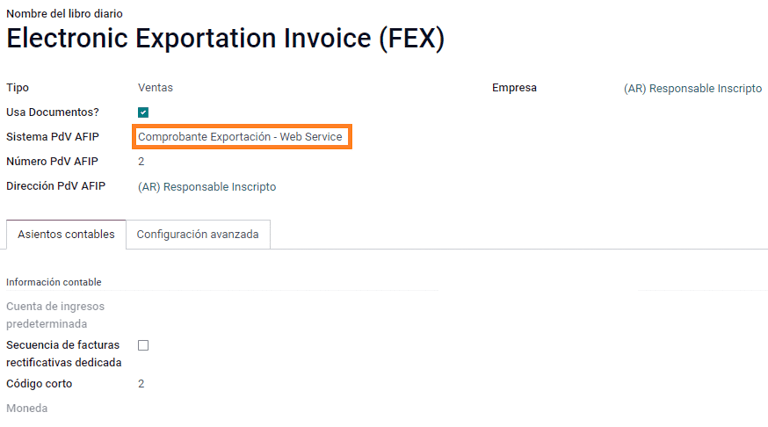

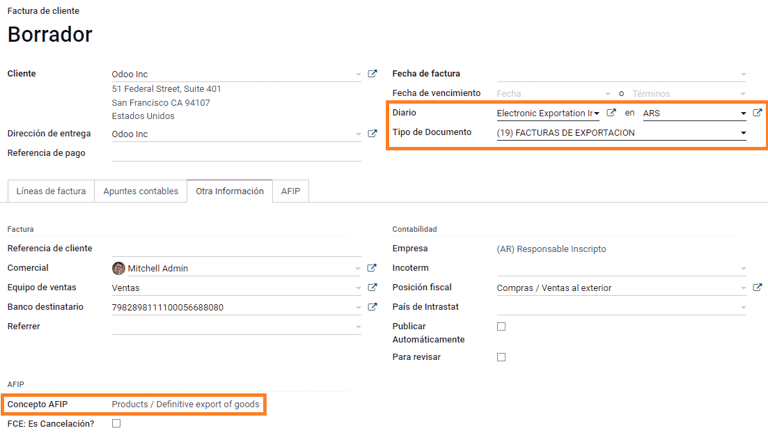

Invoices related to Exportation Transactions require that a journal uses the AFIP POS System Expo Voucher - Web Service so that the proper document type(s) can be associated.

When the customer selected in the invoice is configured with an AFIP responsibility type Cliente / Proveedor del Exterior - Ley N° 19.640, Odoo automatically assigns the:

Journal related to the exportation Web Service;

Exportation document type;

Fiscal position: Compras/Ventas al exterior;

Concepto AFIP: Products / Definitive export of goods;

Exempt Taxes.

注解

The Exportation Documents require Incoterms to be enabled and configured, which can be found in .

Fiscal bond¶

The Electronic Fiscal Bond is used for those who invoice capital goods and wish to access the benefit of the Electronic Tax Bonds granted by the Ministry of Economy.

For these transactions, it is important to consider the following requirements:

Currency (according to the parameter table) and invoice quotation;

Taxes;

Zone;

Detail each item;

Code according to the Common Nomenclator of Mercosur (NCM);

Complete description;

Unit Net Price;

Quantity;

Unit of measurement;

Bonus;

VAT rate.

Electronic credit invoice MiPyme (FCE)¶

For SME invoices, there are several document types that are classified as MiPyME, which are also known as Electronic Credit Invoice (or FCE in Spanish). This classification develops a mechanism that improves the financing conditions for small and medium-sized businesses, and allows them to increase their productivity, through the early collection of credits and receivables issued to their clients and/or vendors.

对于这些交易,必须考虑以下要求:

特定文件类型(201、202、206 等);

排放者应符合 AFIP 的 MiPyME 交易资格;

金额应大于 100,000 ARS;

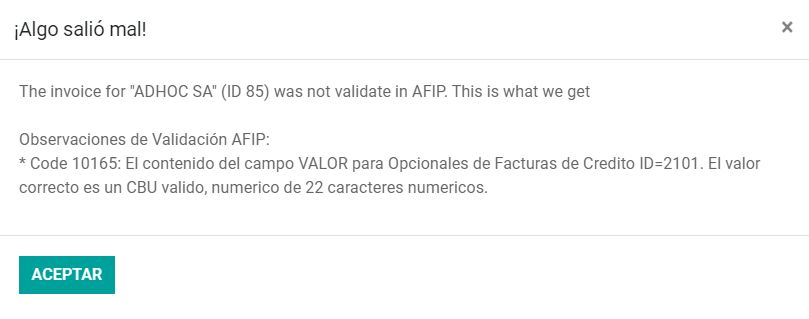

A bank account type CBU must be related to the emisor, otherwise the invoice cannot be validated, having an error message such as the following.

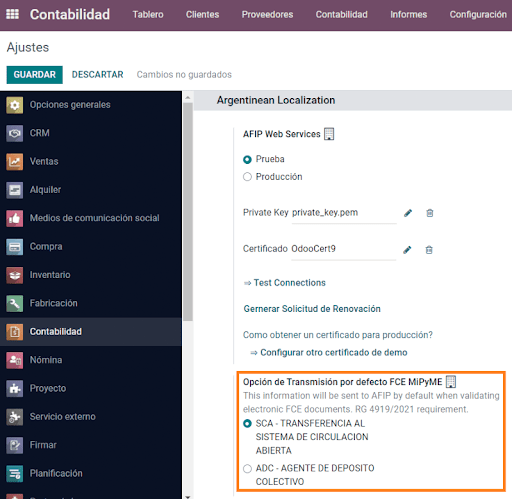

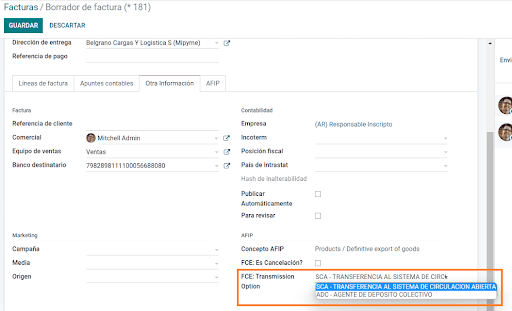

To set up the Transmission Mode, go to settings and select either SDC or ADC.

To change the Transmission Mode for a specific invoice, go to the Other Info tab and change it before confirming.

注解

Changing the Transmission Mode will not change the mode selected in Settings.

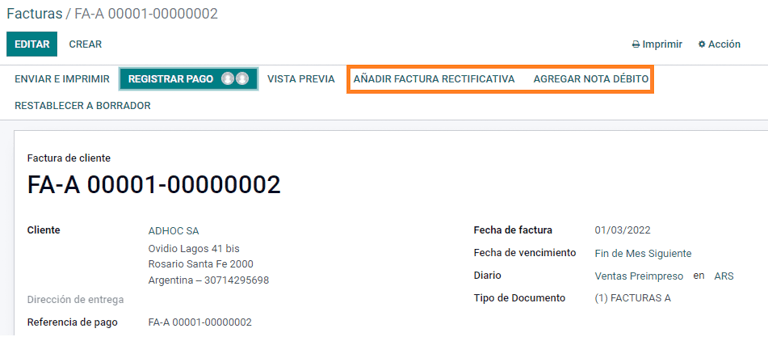

When creating a Credit/Debit note related to a FCE document:

use the Credit and Debit Note buttons, so all the information from the invoice is transferred to the new Credit and Debit Note;

the document letter should be the same as than the originator document (either A or B);

the same currency as the source document must be used. When using a secondary currency there is an exchange difference if the currency rate is different between the emission day and the payment date. It is possible to create a credit/debit note to decrease/increase the amount to pay in ARS.

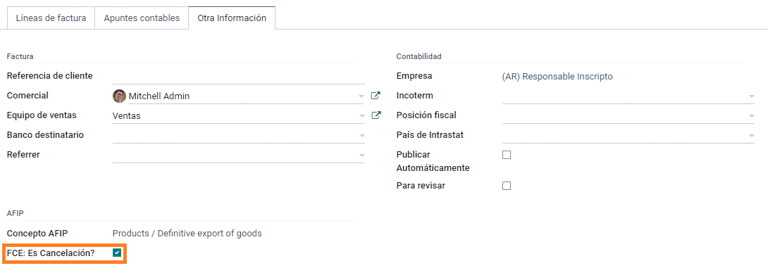

When creating a Credit Note we can have two scenarios:

the FCE is rejected so the Credit Note should have the field FCE, is Cancellation? as True; or;

the Credit Note, is created to annulate the FCE document, in this case the field FCE, is Cancellation? must be empty (false).

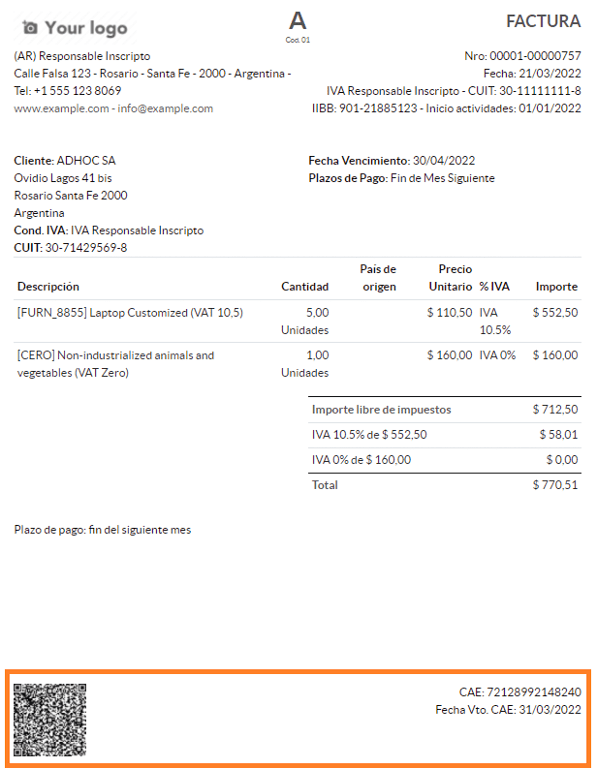

Invoice printed report¶

The PDF Report related to electronic invoices that have been validated by the AFIP includes a barcode at the bottom of the format which represents the CAE number. The expiration date is also displayed as it is a legal requirement.

Troubleshooting and auditing¶

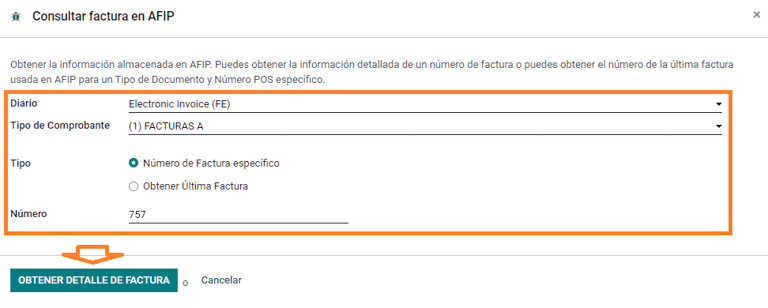

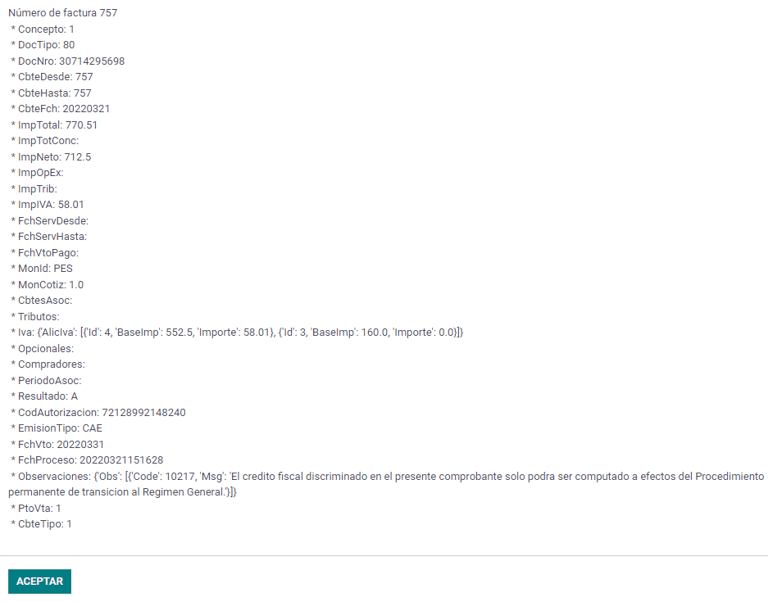

For auditing and troubleshooting purposes, it is possible to obtain detailed information of an invoice number that has been previously sent to the AFIP. To retrieve this information, activate the developer mode, then go to the menu and click on the button Consult Invoice button in AFIP.

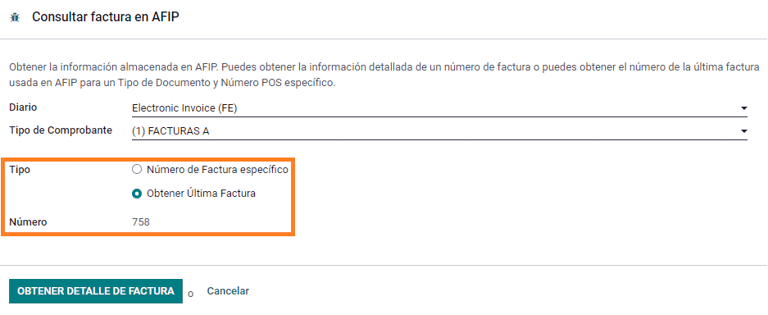

It is also possible to retrieve the last number used in AFIP for a specific document type and POS Number as a reference for any possible issues on the sequence synchronization between Odoo and AFIP.

供应商账单¶

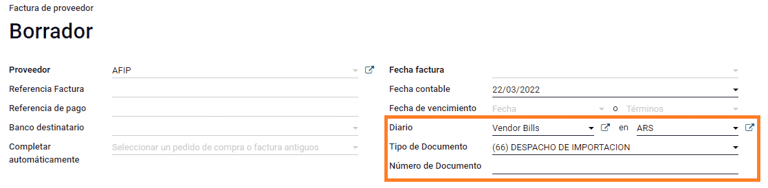

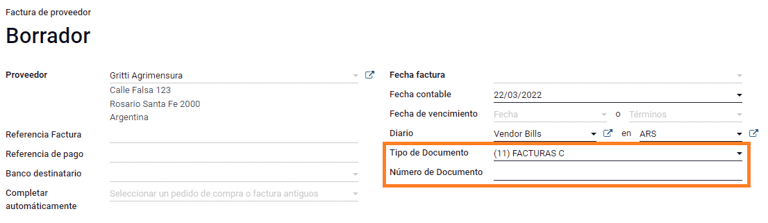

Based on the purchase journal selected for the vendor bill, the Document Type is now a required field. This value is auto-populated based on the AFIP Responsibility type of Issuer and Customer, but the value can be changed if necessary.

The Document Number field needs to be registered manually and the format will be validated automatically. However, in case the format is invalid, a user error will be displayed indicating the correct format that is expected.

供应商账单号的结构与客户发票的结构相同,但用户使用以下格式输入单据顺序:文件前缀 - 字母 - 文件编号。

在 AFIP 中确认供应商账单号¶

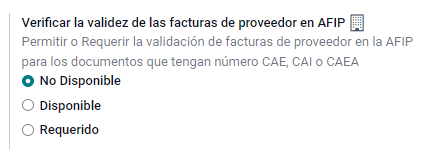

由于大多数公司都有内部控制来验证供应商账单是否与 AFIP 有效文件关联,因此可在 中设置自动验证,并考虑以下级别:

Not available: the verification is not done (this is the default value);

Available: the verification is done. In case the number is not valid it, only displays a warning but still allows the vendor bill to be posted;

Required: the verification is done and it does not allow the user to post the vendor bill if the document number is not valid.

在 Odoo 中验证供应商账单¶

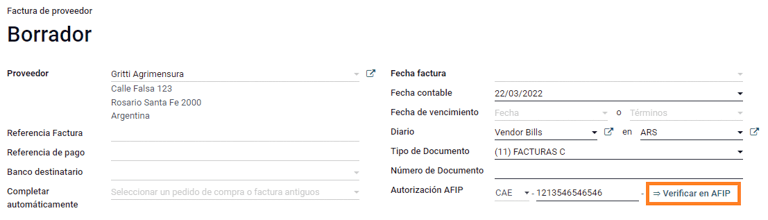

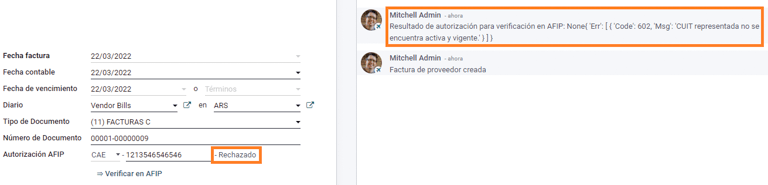

With the vendor validation settings enabled, a new button shows up on the vendor bills inside of Odoo, labeled Verify on AFIP, which is located next to the AFIP Authorization code field.

In case the vendor bill cannot be validated in AFIP, a value of Rejected will be displayed on the dashboard and the details of the invalidation will be added to the chatter.

Special use cases¶

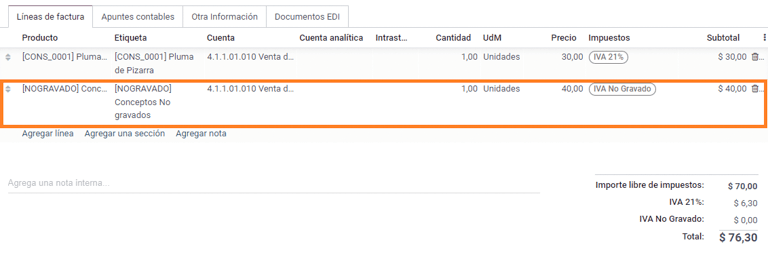

Untaxed concepts¶

有些交易包括不属于增值税基数的项目,如燃料和汽油发票。

在登记供应商账单时,将使用一个项目登记属于增值税基本税额的每种产品,并使用另一个项目登记免税概念的税额。

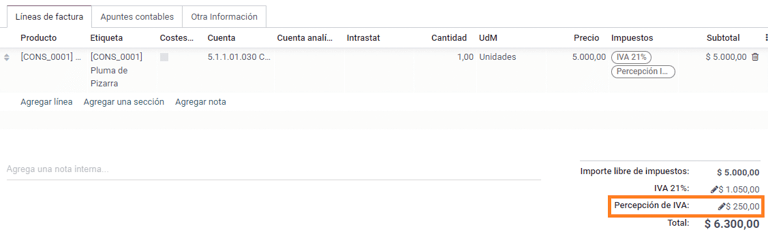

Perception taxes¶

The vendor bill will be registered using one item for each product that is part of the VAT base amount, and the perception tax can be added in any of the product lines. As a result, there will be one tax group for the VAT and another for the perception. The perception default value is always 0.10.

To edit the VAT perception and set the correct amount, you should use the Pencil icon that is the next to the Perception amount. After the VAT perception amount has been set, the invoice can then be validated.

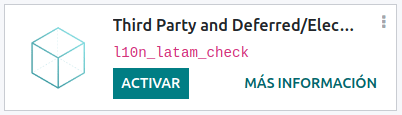

Check management¶

To install the Third Party and Deferred/Electronic Checks Management module, go to

and search for the module by its technical name l10n_latam_check and click

the Activate button.

该模块可对日记账和付款进行必要的配置:

创建、管理和控制各类支票

优化*自有支票*和*第三方支票*的管理

轻松有效地管理自己和第三方支票的过期日期

阿根廷电子发票流程的所有配置完成后,还需要完成自有支票和第三方支票流程的某些配置。

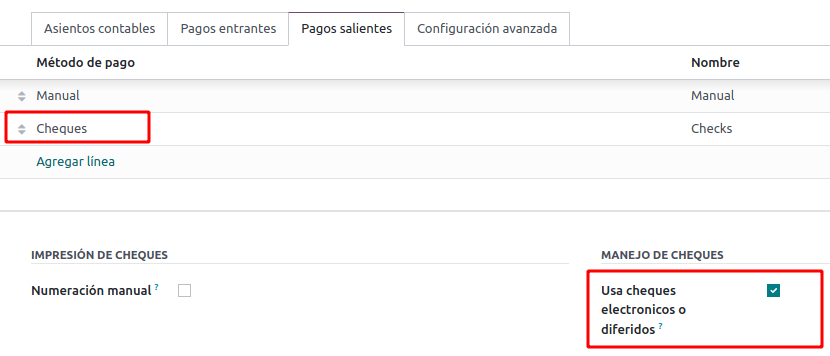

Own checks¶

Configure the bank journal used to create your own checks by going to , selecting the bank journal, and opening the Outgoing Payments tab.

Checks should be available as a Payment Method. If not, click Add a line and type

Checksunder Payment Method to add themEnable the Use electronic and deferred checks setting.

注解

This last configuration disables the printing ability but enables to:

手动输入支票编号

Adds a field to allocate the payment date of the check

Management of own checks¶

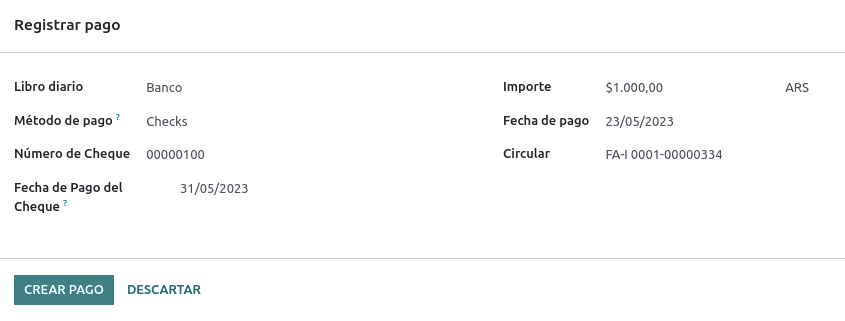

Own checks can be created directly from the vendor bill. For this process, click on the Register Payment button.

On the payment registration modal, select the bank journal from which the payment is to be made and set the Check Cash-In Date, and the Amount.

注解

要管理当前支票,支票兑现日期 字段必须留空或填写当前日期。要管理递延支票,:guilabel:`支票兑现日期`字段必须设置为未来日期。

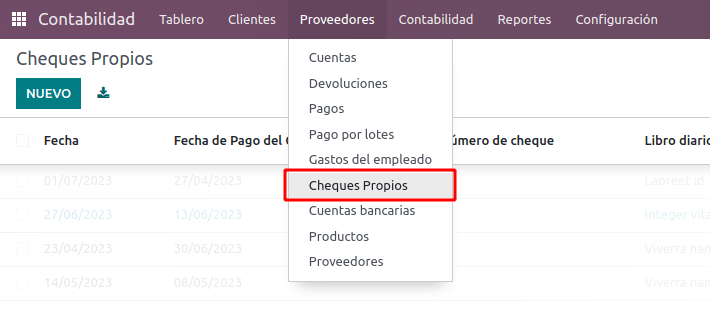

要管理现有的自有支票,请导航至 。该窗口显示关键信息,如需要支付支票的日期、支票总量和支票支付总金额。

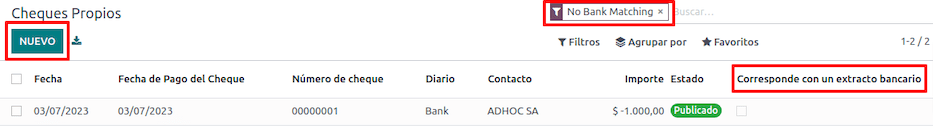

It is important to note that the list is pre-filtered by checks that are still not reconciled with a bank statement - that were not yet debited from the bank - which can be verified with the Is Matched with a Bank Statement field. If you want to see all of your own checks, delete the No Bank Matching filter by clicking on the X symbol.

Cancel an own check¶

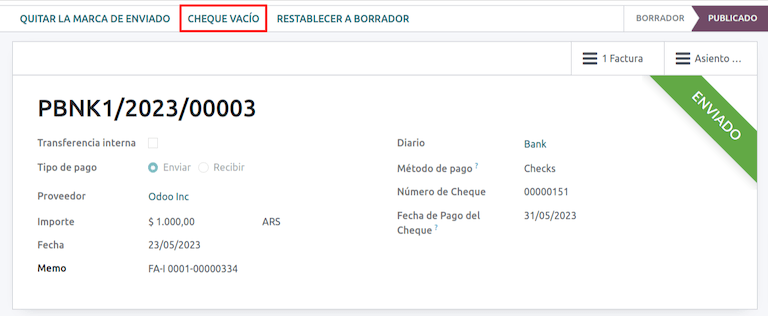

要取消在 Odoo 创建的自有支票,请导航至 并选择要取消的支票,然后点击 作废支票 按钮。这将中断与供应商账单和银行对账单的对账,使支票处于**已取消**状态。

第三方支票¶

要使用第三方支票登记付款,需要配置两个特定的日记账。为此,请导航至 并创建两个新日记账:

第三方支票Rejected Third Party Checks

注解

如果您有多个销售点,需要为这些销售点创建日记账,您可以手动创建更多日记账。

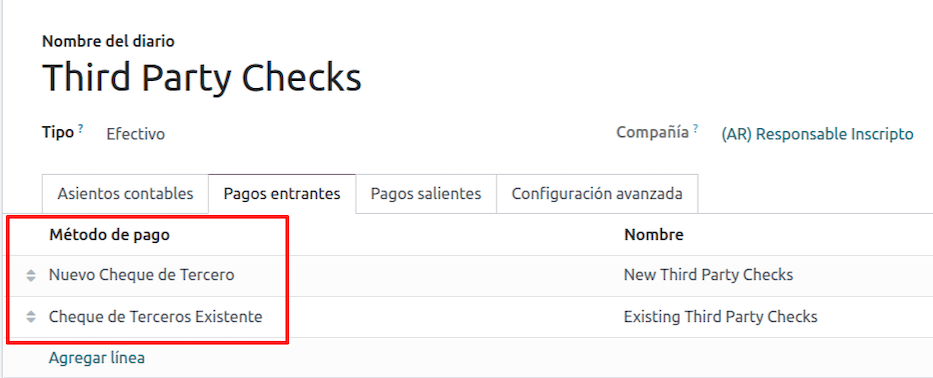

要创建 第三方支票 日志,请单击 新建 按钮并进行以下配置:

输入

第三方支票作为 日记账名称择 现金 为 类型

在 日记账分录 选项卡中,设置 现金账户: 为

1.1.1.02.010 Cheques de Terceros,输入您选择的 简码,并选择 货币 。

可用的付款方式列在*付款*选项卡中:

对于新收到的第三方支票,进入 并选择 新的第三方支票。此方法用于创建*新的*第三方支票。

对于收入和支出的现有第三方支票,转到 并选择 现有第三方支票。在 付款 选项卡中重复相同步骤。此方法用于使用*现有*支票接收和/或支付供应商账单,以及内部转账。

小技巧

您可以删除在配置第三方支票日记账时默认出现的已有付款方式。

还需要创建和/或配置*被拒第三方支票*日记账。该日记账用于管理被拒付的第三方支票,可用于发送收款时被拒付的支票或来自供应商被拒付的支票。

要创建 被拒第三方支票 日志,请单击 新建 按钮并进行以下配置:

输入

被拒第三方支票作为 日记账名称择 现金 为 类型

在 日记账分录 选项卡中,设置 现金账户: 为

1.1.1.01.002 被拒第三方支票,输入您选择的 简码,并选择 货币

使用与*第三方支票*日记账相同的付款方式。

新的第三方支票¶

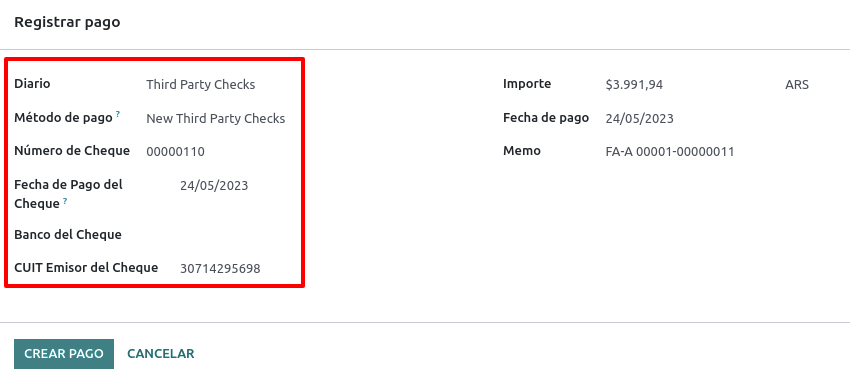

要为客户发票登记*新的*第三方支票,请单击 登记付款`按钮。在弹出窗口中,您必须选择 :guilabel:`第三方支票 作为付款登记的日记账。

选择 新的第三方支票 作为 付款方式,并填写 支票号码、付款日期`和 :guilabel:`支票银行。您可以选择手动添加 支票开具人增值税,但这将根据与发票相关的客户增值税号码自动填写。

现有第三方支票¶

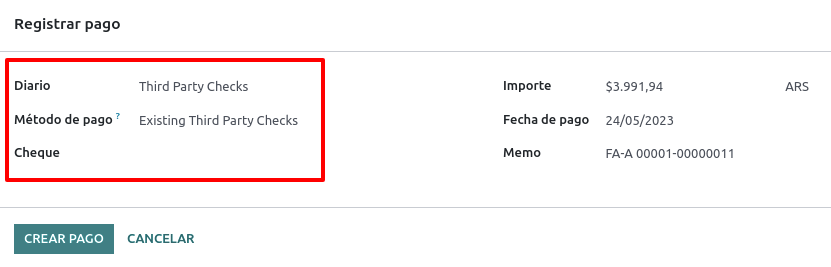

要使用*现有*支票支付供应商账单,请单击 登记付款`按钮。在弹出窗口中,您必须选择 :guilabel:`第三方支票 作为付款登记的日记账。

选择 现有第三方支票 作为 付款方式,并从 支票 字段中选择支票。该字段显示所有**可用的现有支票**,可用于支付供应商账单。

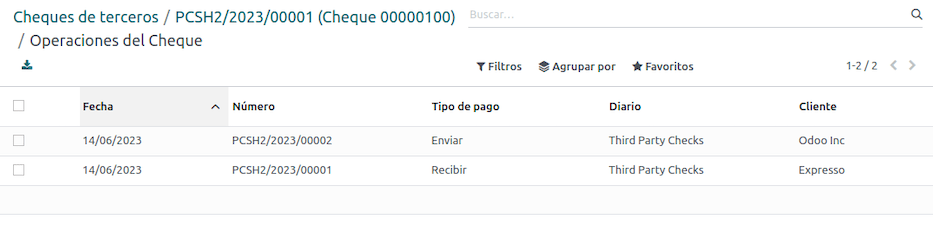

使用**现有第三方支票**时,可以查看与之相关的操作。例如,您可以查看用于支付客户发票的第三方支票后来是否被用作支付供应商账单的现有第三方支票。

要执行此操作,请进入 或 字段中,点击 => 查看操作 查看支票的历史记录和变动情况。

菜单还显示与这些操作相关的重要信息,例如:

guilabel:

付款类型,用于区分是向供应商*发送*的付款,还是从客户*收到*的付款。当前登记支票的 日记账

与操作相关的**合作伙伴**(客户或供应商)。

Ecommerce electronic invoicing¶

Install the Argentinian eCommerce (l10n_ar_website_sale) module to

enable the following features and configurations:

Clients being able to create online accounts for eCommerce purposes.

Support for required fiscal fields in the eCommerce application.

Receive payments for sale orders online.

Generate electronic documents from the eCommerce application.

配置¶

Once all of the configurations are made for the Argentinian electronic invoice flow, it is also necessary to complete certain configurations to integrate the eCommerce flow.

Client account registration¶

To configure your website for client accounts, follow the instructions in the checkout documentation.

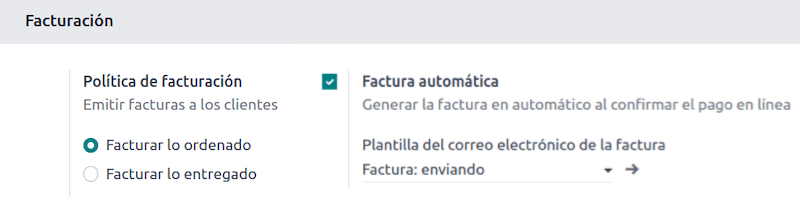

Automatic invoice¶

Configure your website to generate electronic documents in the sales process by navigating to and activating the Automatic Invoice feature in the Invoicing section to automatically generate the required electronic documents when the online payment is confirmed.

Since an online payment needs to be confirmed for the Automatic Invoice feature to generate the document, a payment provider must be configured for the related website.

产品¶

To allow your products to be invoiced when an online payment is confirmed, navigate to the desired product from . In the General Information tab, set the Invoicing Policy to Ordered quantities and define the desired Customer Taxes.

Invoicing flow for eCommerce¶

Once the configurations mentioned above are all set, clients can complete the following required steps in the Argentinian eCommerce flow to input fiscal fields in the checkout process.

Fiscal fields are available for input in the checkout process once the Country field is

set as Argentina. Inputting the fiscal data enables the purchase to conclude in the corresponding

electronic document.

When the client makes a successful purchase and payment, the necessary invoice is generated with the corresponding layout and fiscal stamps stated in the Invoice printed report.

报告¶

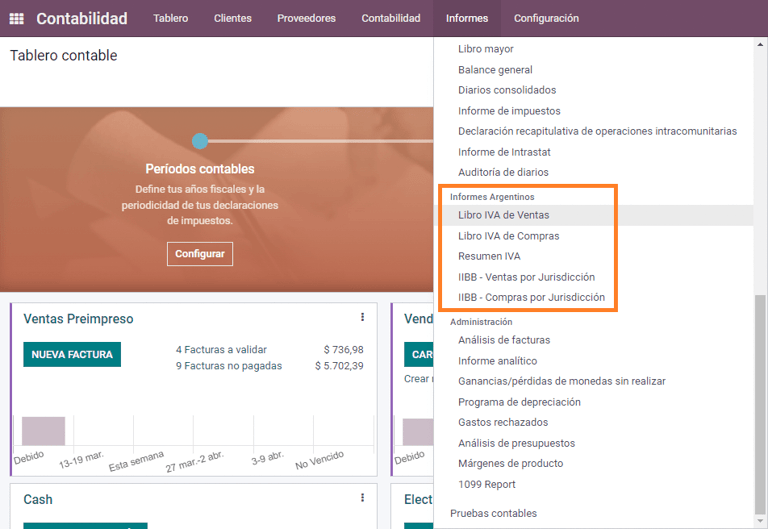

作为本地化安装的一部分,阿根廷的财务报告已添加到 会计`仪表板。通过导航至 :menuselection:`会计 –> 报告 –> 阿根廷报告 访问这些报告。

增值税报告¶

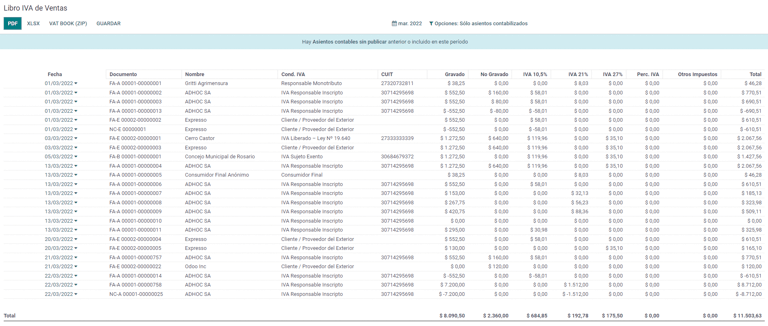

销售增值税账簿¶

在这份报告中,记录了所有销售额,并以此作为会计记录的基础,以确定增值税(借记税款)。

销售增值税`账簿报告可以导出为.zip`文件,增值税账簿(ZIP)`按钮在左上角,其中包含.txt`文件上传到 AFIP 门户网站。

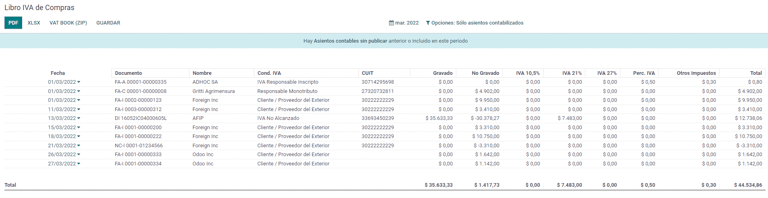

采购增值税账簿¶

采购增值税 账簿报告可以导出为`.zip`文件 增值税账簿(ZIP)`按钮在左上角,其中包含.txt`文件上传到 AFIP 门户网站。

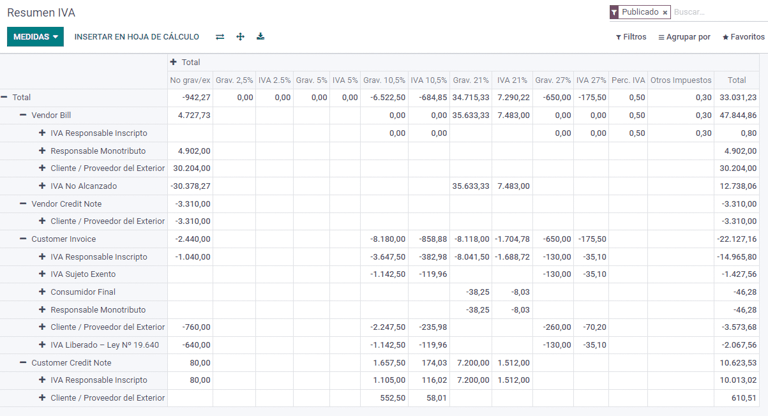

增值税摘要¶

用于检查每月增值税总额的透视表。本报告供内部使用,不发送给 AFIP。

IIBB - 报告¶

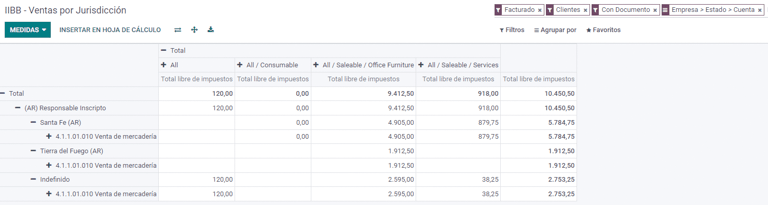

IIBB - 各辖区的销售额¶

透视表,您可以在此确认各辖区的总收入。对应的税款申报表将用于支付相应的税款,因此不会发送给 AFIP。

IIBB - Purchases by jurisdiction¶

Pivot table where you can validate the gross purchases in each jurisdiction. Affidavit for the corresponding taxes to pay, therefore it is not sent to the AFIP.