递延收入¶

递延收入,或**未获收入**,是就尚未交付的货物或尚未提供的服务向客户开具的发票。

公司不能在当前的**损益表**或**收入表**中报告,因为货物和服务将在未来有效交付/提供。

这些未来的收入必须在公司资产负债表的流动负债中递延,直到可以在损益表中一次性或在一个确定的时期内**确认**。

例如,假设一家企业出售了一个为期 1 年、价值 1200 美元的软件许可。他们立即向客户开具发票,但不能将其视为已经获得的收入,因为尚未提供未来几个月的许可证。因此,他们将这笔新收入记入递延收入账户,并按月确认。在接下来的 12 个月中,每个月都将有 100 美元确认为收入。

Odoo 会计系统处理递延收入的方式是将其分摊到多个分录中,并定期公布。

注解

服务器每天检查一次条目是否必须发布。可能需要 24 小时才能看到 草稿 变为 已发布。

配置¶

确保为您的业务正确配置默认设置。为此,请访问 。可使用以下选项:

- 日记账

递延分录记入该日记账。

- 递延费用科目

Expenses are deferred on this Current Asset account until they are recognized.

- 递延收入科目

Revenues are deferred on this Current Liability account until they are recognized.

- 生成分录

By default, Odoo automatically generates the deferral entries when you post a customer invoice. However, you can also choose to generate them manually by selecting the Manually & Grouped option instead.

- 金额计算

Suppose an invoice of $1200 must be deferred over 12 months. The Equal per month computation accounts for $100 each month, while the Based on days computation accounts for different amounts depending on the number of days in each month.

Generate deferral entries on validation¶

为发票中应延迟的每一行指定延迟期的开始和结束日期。

如果**设置**中的 生成分录`字段设置为 :guilabel:`发票/账单验证时,Odoo 会在发票验证时自动生成递延分录。点击 递延分录 智能按钮查看。

One entry, dated on the same day as the invoice’s accounting date, moves the invoice amounts from the income account to the deferred account. The other entries are deferral entries which, month after month, move the invoice amounts from the deferred account to the income account to recognize the revenue.

Example

您可以将 1 月份的 1200 美元发票递延 12 个月,指定开始日期为 2023 年 1 月 1 日,结束日期为 2023 年 12 月 31 日。8 月底,800 美元被确认为收入,而 400 美元仍留在递延账户上。

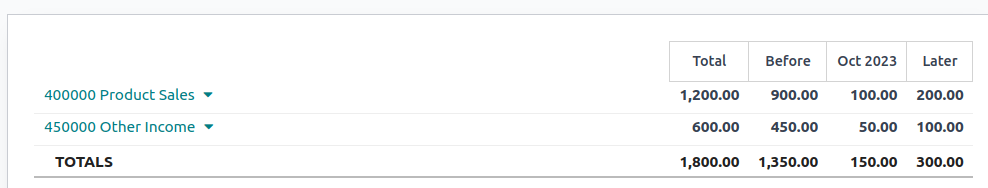

报表¶

递延收入报告计算每个账户必要的递延分录概览。要访问它,请转到 。

要查看每个账户的日记账项目,请点击账户名称,然后点击 日记账项目。

注解

只有会计日期在报告期结束之前的发票才会被考虑在内。

Generate grouped deferral entries manually¶

如果有大量递延收入,并希望减少创建的日记账分录数量,可以手动生成递延分录。为此,请将**设置**中的 生成分录`字段设置为 :guilabel:`手动和分组。然后,Odoo 会将递延金额汇总到一个条目中。

每月月底,进入 ,然后单击 :guilabel:`生成分录`按钮。这将生成两个递延分录:

月末的一个日期,汇总了每个账户当月的所有递延金额。这意味着部分递延收入在该期末得到确认。

The reversal of this created entry, dated on the following day (i.e., the first day of the next month) to cancel the previous entry.

Example

有两种发票:

发票 A:$ 1200,从 2023 年 1 月 1 日递延至 2023 年 12 月 31 日

发票 B:$ 600,从 2023 年 1 月 1 日递延至 2023 年 12 月 31 日

- 一月

一月底,点击 生成分录 按钮后,会出现以下分录:

Entry 1 dated on the 31st January:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both invoices)

Line 2: Expense account 100 + 50 = 150 (recognizing 1/12 of invoice A and invoice B)

Line 3: Deferred account 1800 - 150 = 1650 (amount that has yet to be deferred later on)

Entry 2 dated on the 1st February, the reversal of the previous entry:

Line 1: Expense account 1800

Line 2: Deferred account -150

Line 3: Expense account -1650

- 二月

At the end of February, after clicking the Generate Entries button, there are the following entries:

Entry 1 dated on the 28th February:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both invoices)

Line 2: Expense account 200 + 100 = 300 (recognizing 2/12 of invoice A and invoice B)

Line 3: Deferred account 1800 - 300 = 1500 (amount that has yet to be deferred later on)

Entry 2 dated on the 1st March, the reversal of the previous entry.

- From March to October

The same computation is done for each month until October.

- 十一月

十一月底,点击 生成分录 按钮后,会出现以下分录:

Entry 1 dated on the 30th November:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both invoices)

Line 2: Expense account 1100 + 550 = 1650 (recognizing 11/12 of invoice A and invoice B)

Line 3: Deferred account 1800 - 1650 = 150 (amount that has yet to be deferred later on)

Entry 2 dated on the 1st December, the reversal of the previous entry.

- In December

There is no need to generate entries in December. Indeed, if we do the computation for December, we have an amount of 0 to be deferred.

- In total

If we aggregate everything, we would have:

invoice A and invoice B

two entries (one for the deferral and one for the reversal) for each month from January to November

Therefore, at the end of December, invoices A and B are fully recognized as income only once in spite of all the created entries thanks to the reversal mechanism.